Every branch of the government faces unique challenges in regard to its payment systems. However, the modern demands for digital payment solutions are increasing rapidly. Each municipality needs to implement digital government payment solutions so they can maintain trust of their citizens.

This guide will explain the demands and difficulties of existing systems and, in turn, explain how CORE payment processing solutions for government will streamline processes and provide successful solutions for your agency.

Introduction

This eBook addresses seven specific government roles associated with payment processing solutions and challenges they often face. We will then explain how these pain points are solved or mitigated through CORE.

Table of Contents:

Chapter 1: Chief Technology Officer (CTO) Pain Points and Solutions

Chapter 2: Comptroller Pain Points and Solutions

Chapter 3: Compliance Manager Pain Points and Solutions

Chapter 4: Budget and Finance Team Pain Points and Solutions

Chapter 5: Treasurer Pain Points and Solutions

Chapter 6: Community Event Manager Pain Points and Solutions

Chapter 7: City and Council-Manager Pain Points and Solutions

Chapter 8: Payment Processing Systems That Solve Pain Points for Each Role

Chapter 9: Why CORE

or continue reading the eBook below.

Chapter 1: Chief Technology Officer (CTO) Pain Points and Solutions

CTOs see costs rise when errors are made or important details are overlooked. However, there are solutions to this common problem.

Pain Points

- It is often difficult for CTOs to see the granular details of each step in the process. This makes it easy for some details to slip through the cracks and become forgotten. This missing data can eventually add up to become a complicated issue.

- The muddled communication between teams and employees can inadvertently cause miscommunications and inhibit the success of programs and their implementation.

- The CTO sees costs increase when underperforming systems cause hiccups or need extra attention and maintenance. Budget overages CTOs have to answer for will result.

Solutions

- CORE systems have insightful and accurate reporting advances with report generator software, a configurable payment and revenue reporting tool with multiple templates. CORE also supports intelligent organizational development where all your records are easily accessible and visible.

- All teams and employees can access the same data sets in POS, ERP, CRM, payment gateway systems, and IVR systems through integrated systems, like Infor, Oracle, SAP, and Workday, along with credit cards and financial institutions like Wells Fargo, Bank of America, and CitiBank. Flat file exchanges, real time API integrations, and data-handoffs are among the examples of integration methods that can be accommodated.

Every system will be on the same page at the same time, improving the success rate and efficiency of programs and reducing the amount of miscommunication across the organization.

- Automated systems accelerate payment processes and decrease the possibility of errors. Updated systems are more efficient, reducing the need for extra maintenance and CTO attention.

Chapter 2: Comptroller Pain Points and Solutions

Comptrollers oversee the accounting systems for an entire city, county, or state. Pain points are often connected to compliance and process visibility.

Pain Points

- Late payments and those that take a while to process create cash flow restrictions, inhibiting the work the office can accomplish and impacting deadlines.

- PCI compliance regulations need to be followed exactly. Compliance issues cause major internal problems, setbacks, loss of valuable time, and hefty expenses.

- Without a clear line of sight into every step of the payment process, it’s often impossible for comptrollers to spot the tiny errors that can eventually build up into serious financial issues.

Solutions

- The flexibility of digital payment options makes it easier for citizens to pay their bills on time. They can receive texts and emails as reminders to pay online and visit a physical location to pay at a kiosk if necessary. Modern, convenient options mean payments are less likely to be late, so your organization will not deal with restricted cash flow.

- A high-security payment system eliminates the risk of complicated PCI-related internal issues and protects your data. This also improves the productivity level of yourself and your team as you do not have to worry about compliance.

- Detailed reports that allow organizations to see every step in the payment process enable comptrollers to see the details of each transaction and discover profound insights into government financial records and spot errors immediately when they occur.

Chapter 3: Compliance Manager Pain Points and Solutions

Compliance is everybody’s responsibility—but the buck stops with the compliance manager.

Pain Points

- No government agency wants errors in their records; unfortunately, humans make mistakes. Manual data entry can cause errors that have the potential to violate important financial, government, and confidentiality policies. This harms both the citizens and the government’s reputation.

- Sensitive, private data can fall into the wrong hands if security isn’t where it needs to be. Your system is only as secure as its weakest link. CORE maintains secure, detailed logs of all user activity to track system access and audit activity across your department.

- Disconnected systems create a multitude of issues, including mismanaged data and the tendency for error. Systems that don’t communicate also pose serious liability risks to an organization. When using multiple systems, you also need to train employees in all of them, which takes time and money.

Solutions

- Automated processes mitigate the risk of human error. And since CORE systems comply with PCI guidelines, they significantly reduce the chances of violation from outside sources.

- The compliance management standards of a CORE system mean your organization has a more secure system less likely to experience breaches.

- Connected systems allow for a streamlined process that naturally reduces errors. It also minimizes organizational liability, protecting both the compliance manager and the branch of government they work for. It also reduces the amount of time spent training new employees as there is only one system they need to learn.

Chapter 4: Budget and Finance Team Pain Points and Solutions

Every member of a budget and finance team faces common issues with payment systems. All of their pain points have solutions when they implement CORE systems.

Pain Points

- Separate reports lacking continuity obscure the whole picture and allow crucial details to go unnoticed.

- Manual data input is resource-intensive, time-consuming, and prone to errors.

- To achieve a high level of accuracy and stay within PCI compliance rules, organizations require granular reporting. This level of detail is difficult and tedious to complete without the correct tools.

Solutions

- CORE tracking systems track every single dollar during each step of the payment process. This includes the payment, reconciliation, and reporting processes. Budget and finance teams see the whole picture at once.

- CORE’s iPayment SaaS automation system eliminates the need for manual data entry. This automation allows for reduced costs, decreased risks, and fewer wasted resources.

- Risks related to PCI compliance are eliminated with built-in checks in the digital system and hands-off granular reporting.

Chapter 5: Treasurer Pain Points and Solutions

Treasurers often take on the bulk of responsibilities related to financial transactions in a government agency. Their pain points can be resolved with CORE solutions.

Pain Points

- Manual data entry opens the door for inaccuracies that disrupt the reconciliation process.

- Essential information falls through the cracks with disconnected systems. Missing data can be difficult to recover, even if the treasurer realizes the issue.

- Data-driven strategies are impossible without visibility and a clear look at the big picture. Unfortunately, not all financial systems provide this sort of visibility.

Solutions

- Automated data entry ensures accuracy, resulting in efficient reconciliation.

- Our integrated iPayment SaaS system speeds up every aspect of the billing process and tracks and records transactions through major credit cards and financial institutions. They also decrease the occurrence and frequency of errors and the need for treasurers to double-check that data has been recorded correctly.

- CORE systems use top-level security to protect the financial information of citizens and your treasury records. It also provides a level of transparency that enables treasurers to see the big picture and create strategies based on it.

Chapter 6: Community Event Manager Pain Points and Solutions

Community events bring people together and improve morale, but the wrong payment system is headache-inducing for the event manager.

Pain Points

- Payment systems that lack the same basic features found elsewhere (e.g., text-to-pay) ends in frustration for and distrust on behalf of constituents.

- Unorganized and scattered planning is the precursor to disorganized public events. Unfortunately, it’s very easy to foster distrust in a community with poorly organized events.

- Complicated ticketing systems and revenue management platforms inhibit access and lowers engagement among citizens used to using mobile, social, notifications, etc. to pay for and use event tickets.

Solutions

- The flexibility of online payment platforms allows citizens to make purchases on their terms, establishing trust between them and the government. This flexibility makes events and ticket purchasing far more accessible for everyone.

- Our high-quality security features keep private all your citizens’ sensitive information and your department’s plans regarding events and their logistics. You control the release of information on your timetable.

- Simplified event management and ticketing software drives more sales, resulting in a larger community turnout.

Chapter 7: City and Council-Manager Pain Points and Solutions

Cities and cities using council-manager government have a lot to keep track of. Your payment system should make your job easier.

Pain Points

- Disjointed systems mean citizens get the runaround as they try to find the right person to help. This hampers their confidence in the city government.

- Low engagement and limited communication make community connection a challenge.

- Low engagement means you’re not listening and making changes your residents want—evolving technology and opportunities for everyone.

Solutions

- Connected systems work more efficiently and build trust. There’s no need for constituents to feel like they’re on a wild goose chase when government systems interact seamlessly and give answers quickly.

- Better service through online platforms and encouragement from government agencies to use these platforms creates a more prosperous and interconnected community with citizens who are genuinely interested in using government systems and platforms.

- Services tailored to fit community needs increase the trust citizens have in the government, which can result in a higher number of citizens turning out to vote.

Chapter 8: Payment Processing Solutions That Solve Pain Points for Each Role

With unique challenges facing each team and department, it can seem impossible to find a solution that solves all your problems. However, CORE has been created to solve major pain points and provide each government agency with solutions for their billing needs.

CORE System Options to Solve Pain Points

Payment processing systems are not one-size-fits-all. It all depends on the needs of the individual team or agency. That’s why CORE offers multiple solutions.

The table below describes common pain points and shows which platforms offer the best solutions. Compare the available payment systems to determine which best fit your needs.

| PAIN POINT #1: Disconnected / Manual Processes |

PAIN POINT #2: Risk Management and Compliance |

PAIN POINT #3: Meeting the Evolving Customer Experience |

PAIN POINT #4: Reliability of Reconciliation |

|

|---|---|---|---|---|

| EBPP | ✓ | ✓ | ✓ | ✓ |

| Online Payments | ✓ | ✓ | ✓ | ✓ |

| Cashiering | ✓ | ✓ | ||

| Text-2-Pay | ✓ | ✓ | ||

| Self-Service Payments | ✓ | ✓ | ✓ | |

| Mobile Payments | ✓ | ✓ | ||

| ACH/eCheck Payments | ✓ | ✓ | ✓ | ✓ |

| Hosted IVR | ✓ | ✓ | ✓ | |

| POS/Devices Peripherals | ✓ | ✓ | ✓ | ✓ |

| Terminals | ✓ | ✓ | ✓ | |

| Wire Transfer | ✓ | ✓ |

CORE Payment Solutions

CORE payment solutions are vast and available to any government group needing a more efficient, accurate, and safe way to handle fund transfers.

EBPP

EBPP (electronic bill presentment and payment services) Is a digital-ready, connected solution for payment processing that allows organizations to manage regular or periodic billing needs. EBPP combines elements of payment presentation, acceptance, and processing in one, secure platform.

This payment solution is notable for reducing friction in the payments process, which can help meet your constituents’ expectations. When your constituents make payments for utilities, property taxes, licenses, permits, and more, they can benefit from this fully integrated digital payment system.

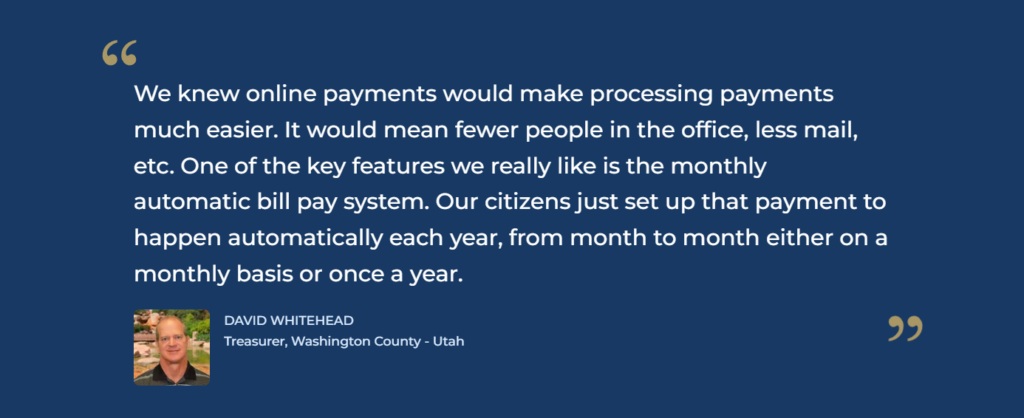

Online Payments

The world is changing rapidly—we’re becoming more connected than ever before in a wide variety of ways. Your constituents have less time to travel to government offices to make payments. Additionally, many agencies get backed up when each employee needs to process payments manually.

Government organizations often lack a sufficient self-service strategy, which can impact the constituent experience. This is where online payments come in handy.

An online payment processing option operates around the clock, 24/7. These solutions employ an extremely flexible user interface to process web-based payments. Online credit card processing solutions are easily integrated with gateway, kiosk, and system integrator solutions to create a secure self-service payment option.

Cashiering

Few things are more stressful for large organizations than the end-of-day batch reconciliation process. It might be a simple task for small businesses and organizations with minimal departments, but it can be complicated and time-consuming for government agencies with multiple components to track.

You can easily streamline revenue management with a SaaS-based, scalable cashiering solution. This payment system allows you to accept full or partial payments across all tender types while connecting to individual departments. The entire process integrates with your general ledger.

A cashiering platform enables the efficient consolidation of processes and systems. It enables rapid reconciliation at the end of the day at every level of your organization.

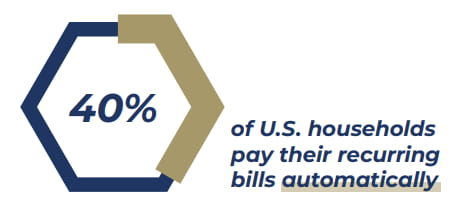

Text-2-Pay

If any payment option embodies our digital era’s preference for convenience, it’s Text-2-Pay. This is an increasingly popular solution among many businesses, so your constituents are likely familiar with the process already. Leveraging the power of Text-2-Pay uses automation to make payments easier and more convenient.

Text-2-Pay sends a text message link directing the individual to a secure online payment portal. There, they input their credit card information and effortlessly make a payment. For government agencies struggling to implement self-service payment options, Text-2-Pay is an ideal solution.

Self-Service Payments

One of the greatest payment processing bottlenecks for organizations of all kinds is availability. Government employees aren’t available to accept payments 24/7, which can lead to delayed payments and more friction throughout the process. Self-service payment solutions allow your organization to accept payments around the clock.

One of the easiest ways to streamline payment acceptance is to provide an unattended self-service payment solution. Implementing this option leads to higher efficiency, flexibility, and customer adoption, plus reduced inbound calls for assistance.

Wondering which payment options provide consistency in on-time bill payments? Self-service payment platforms make a strong case. The added convenience and ease make it easier to pay on time.

Mobile Payments

It’s reasonable to assume that nearly everyone uses their mobile devices for hours daily, so accepting mobile payments can be incredibly convenient for all parties involved.

Contactless mobile payments are increasingly common, and as a government organization, you can harness the ease of processing to increase both efficiency and security.

ACH/eCheck Payments

While more people are paying with credit cards than ever, many individuals still prefer to pay via electronic check. Paper checks have been trusted for over a century, but many continue to trust and rely on automated clearing house (ACH) and electronic check (eChecks) options. Some of these preferences are due to behavior and habits, and others want to avoid the fees associated with card payments.

Either way, offering eCheck and ACH payments can be a great way to increase accessibility for residents.

Hosted IVR

IVR (interactive voice response) is an excellent option for providing over-the-phone payment processing to your constituents. It’s an entirely automated self-service platform that can improve the customer experience.

Hosted IVR platforms can accept payment by ACH, credit, debit, and prepaid cards. When you select the right solution, you can leverage unlimited inbound volume, flexible payment options, and more. Additionally, you can create a recognizable broadcast voice that keeps payers well-informed with voice reminders and payment processing updates.

POS/Devices Peripherals

When looking for the perfect point-of-sale (POS) solution, you want something that embodies both convenience and security. Even better, an entirely integrated solution means you no longer worry about disconnected processes causing important information to slip through the cracks.

POS solutions tie front-end payments to back-office accounting and POS devices, maximizing in-person and online payment experience and improving internal security.

The ideal POS solution and peripheral device support a variety of entry methods, including:

- EMV/chip cards

- NFC (e.g., Apple Pay)

- Other contactless payment options

- Swipe

- Point-to-point encryption (P2PE)

Terminals

You’ll find a terminal at the center of any well-integrated payment system. It’s the backbone of a well-rounded payment system, particularly if you accept in-person and online payments.

Terminals can be physical hardware devices (like traditional countertop POS terminals), portable mobile devices, or even virtual credit card processing tools. You’ll need one that accepts all major card brands and offers an extensive feature set.

Ensuring your organization uses secure terminals and integrations in a holistic system will transform your process, ensuring payments and data are kept safe.

Wire Transfer

How could wire transfer be helpful to your government organization’s processes? A wire transfer (also known as a bank transfer) is a direct transmission of funds from one bank account to another. Of course, there’s a little more involved in the process, such as payment validation. That’s where a well-integrated payment platform comes into play.

With the right platform and systems in place, wire transfers are secure and reliable.

Chapter 9: Why CORE

There are many options for your government agency when setting up a digital payment system. CORE stands out because of our automated account reconciliation, enhanced customer engagement, PCI compliance, and streamlined processes. These features ensure that your group will experience fewer issues regarding payment processing. The time you usually spend fixing errors and manually entering data can then be spent on more important projects.

Automated Account Reconciliation

Running the financial operations of a government organization requires accuracy, security, and compliance as top priorities. Citizens count on your services, and you trust that your account reconciliation software drives efficiency across your organization.

Manual processes, along with payment reconciliation, cause:

- Costly errors from inaccurate manual data entry

- Higher operational costs

- Slow revenue collection

- Stressful workloads on teams

Reconciling every transaction across all payment channels for your agency is an overwhelming, ineffective, and outdated practice.

By transitioning to an automated account reconciliation solution for your government agency, CORE delivers an end-to-end solution for inconsistent accounting, heavy workloads, and expensive errors.

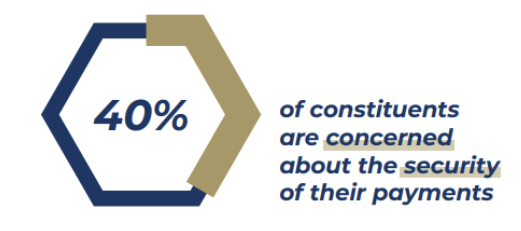

Enhanced Customer Engagement

The payment system you have set up is critical to a satisfactory citizen experience. Benefit from higher payment on-time and completion rates when you focus on providing an enhanced payment experience—with CORE’s payment solutions. Are you meeting evolving resident expectations?

A poor payment experience means:

- Difficulty collecting payments

- Increase in default payments

- Lack of confidence and trust between your organization and citizens

- Concerns over data security and privacy online or via mobile app

- More customer service needs that require staff attention

- Risk of non-compliance with contracts, terms and conditions, PCI standards, and website ADA standards

- A slow and frustrating process for facility reservations and event ticketing, reducing potential income and lowering community engagement

To keep up with evolving payment experience expectations, switch to a system that encourages civic engagement and increases citizen satisfaction. Meet your customers where they are by leveraging CORE’s integrated payment solutions to enhance the citizen experience.

CORE’s system makes it simple to collect, process, and reconcile payments across the enterprise.

PCI Compliance

If your government organization still uses legacy systems (including outdated terminals), you could be at risk of being out of the PCI scope. This comes with a host of consequences, such as losing customer confidence and incurring related costs.

If you’re using a non-compliant system, you could be at risk for:

- Creating inaccurate audits

- Tracking transactions incorrectly

- Losing your customers’ confidence

- Violating PCI compliance

To reduce the risk of non-compliance, CORE provides a Level 1 PCI DSS-compliant software solution that streamlines payment acceptance and processing across every touchpoint.

Count on CORE as the leading payment platform that meets regulatory government compliance. Our revenue management system can lighten the burden and streamline your entire financial process in one go.

Streamlined Processes

Manual data entry and reconciliation are exhausting, costly, and inefficient. Track every payment for every channel, from every device—starting from the first cash transaction to the last general ledger reconciliation, with CORE streamlined processes.

Inefficient systems can mean:

- A lack of continuity across payment channels

- Difficulty collecting revenue quickly

- Costly processing fees

- Unreliable systems

To meet your government agency’s needs, switch to an integrated payment platform.

CORE is an all-in-one hosted solution

We provide all facets of revenue management to drive collections and provide a modern consumer experience:

- Payment Facilitator

- Account Receivable

- Integrations

- General Ledger

- Trust System

- Cashiering

- Bank Reconciliation

- Reporting

Meet your customers where they are, and transcend your fragmented systems by leveraging CORE’s integrated payment solutions to accelerate revenue collection for your organization.

CORE’s system standardizes the collection, processing, and reconciliation of payments across the enterprise.

Integrations include:

- POS (credit cards and financial institutions)

- ERP (Infor, Oracle, SAP, Workday, etc.)

- CRM

The CORE Difference

CORE was founded to help the modern enterprise deliver a seamless payment system, facilitate revenue management, and strengthen consumer engagement. More than 1600 organizations use CORE every single day.

Today’s enterprise landscape is changing. The accelerated focus on empowering digital-ready experiences continues to sweep across the enterprise, and it is fundamentally changing how you enable more reliable, sustainable, and secure revenue management and customer engagement solutions. Many organizations attempt to patch together various solutions, data sources, and strategies, but they fall short of creating a cohesive brand experience.

CORE believes you can not only survive but thrive in the Experience Era because you can modernize connected experiences across the enterprise by enabling visibility into every step of payment and engagement activities, inciting immediacy by supporting anytime, anywhere access while matching the speed of the evolving consumer experience without sacrificing control.

We have shown how CORE can address the individual issues related to the specific needs of different roles within a government agency or department. The systems and platforms CORE has to offer these groups will provide streamlined processes that require little to no manual data entry or supervision. This frees up time, energy, and staff so your group can focus on more important concerns.

Never worry about your payment processing systems again when you use CORE technology. Visit CORE and chat with a representative who can guide you through the process and find the best government payment solutions to fit your needs.